Balancing Charge Depreciation . sections 12(1)(b) and 12(5) of the inland revenue ordinance (the ordinance) provide for depreciation allowances and. For this, you add a balancing charge to your profit. an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in your. balancing charges arise when an asset is sold for more than its tax written down value, leading to a potential tax liability. the sr allowance gives relief at 50% of the qualifying cost in the first year with the balance going into the normal special rate pool to be written down at the usual 6% rate in future. It arises when a business sells, disposes of, or ceases to use. a balancing charge is a concept within the uk's capital allowances framework. a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value.

from thirdspacelearning.com

a balancing charge is a concept within the uk's capital allowances framework. balancing charges arise when an asset is sold for more than its tax written down value, leading to a potential tax liability. the sr allowance gives relief at 50% of the qualifying cost in the first year with the balance going into the normal special rate pool to be written down at the usual 6% rate in future. sections 12(1)(b) and 12(5) of the inland revenue ordinance (the ordinance) provide for depreciation allowances and. a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. For this, you add a balancing charge to your profit. an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in your. It arises when a business sells, disposes of, or ceases to use.

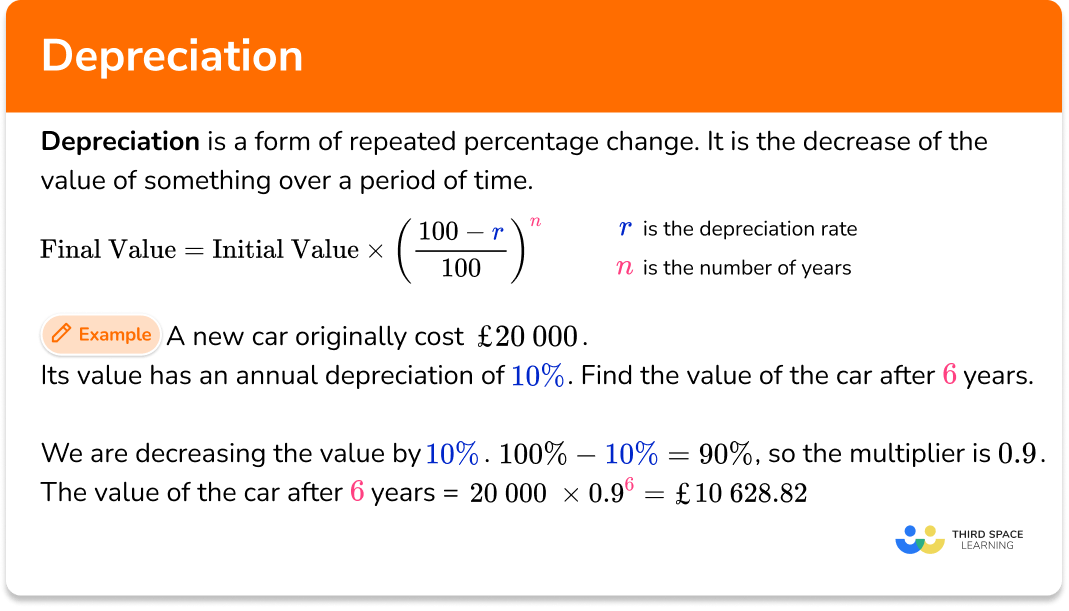

Depreciation GCSE Maths Steps, Examples & Worksheet

Balancing Charge Depreciation a balancing charge is a concept within the uk's capital allowances framework. the sr allowance gives relief at 50% of the qualifying cost in the first year with the balance going into the normal special rate pool to be written down at the usual 6% rate in future. a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. sections 12(1)(b) and 12(5) of the inland revenue ordinance (the ordinance) provide for depreciation allowances and. a balancing charge is a concept within the uk's capital allowances framework. For this, you add a balancing charge to your profit. an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in your. balancing charges arise when an asset is sold for more than its tax written down value, leading to a potential tax liability. It arises when a business sells, disposes of, or ceases to use.

From www.deskera.com

What is Accumulated Depreciation? How it Works and Why You Need it Balancing Charge Depreciation a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in your. sections 12(1)(b) and 12(5) of the inland revenue ordinance (the ordinance) provide for depreciation allowances. Balancing Charge Depreciation.

From www.journalofaccountancy.com

8 ways to calculate depreciation in Excel Journal of Accountancy Balancing Charge Depreciation balancing charges arise when an asset is sold for more than its tax written down value, leading to a potential tax liability. a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. the sr allowance gives relief at 50% of the qualifying cost in the first year with. Balancing Charge Depreciation.

From www.youtube.com

PGBP 6 Terminal depreciation vs balancing charge vs STCG Balancing Charge Depreciation For this, you add a balancing charge to your profit. a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in your. balancing charges arise when an. Balancing Charge Depreciation.

From www.youtube.com

Lecture 40 Sec 32 Terminal Depreciation & Balancing Charge (Part 7 Balancing Charge Depreciation sections 12(1)(b) and 12(5) of the inland revenue ordinance (the ordinance) provide for depreciation allowances and. It arises when a business sells, disposes of, or ceases to use. a balancing charge is a concept within the uk's capital allowances framework. a balancing charge is calculated when you sell a piece of equipment at a higher tax written. Balancing Charge Depreciation.

From slideplayer.com

Introduction Capital Allowances Depreciation specifically disallowed Balancing Charge Depreciation the sr allowance gives relief at 50% of the qualifying cost in the first year with the balance going into the normal special rate pool to be written down at the usual 6% rate in future. a balancing charge is a concept within the uk's capital allowances framework. balancing charges arise when an asset is sold for. Balancing Charge Depreciation.

From accountingplay.com

Profitable Method DecliningBalance Depreciation Balancing Charge Depreciation balancing charges arise when an asset is sold for more than its tax written down value, leading to a potential tax liability. sections 12(1)(b) and 12(5) of the inland revenue ordinance (the ordinance) provide for depreciation allowances and. an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop. Balancing Charge Depreciation.

From www.double-entry-bookkeeping.com

Reducing Balance Depreciation Calculation Double Entry Bookkeeping Balancing Charge Depreciation a balancing charge is a concept within the uk's capital allowances framework. an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in your. a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. the sr. Balancing Charge Depreciation.

From haipernews.com

How To Calculate Depreciation Balance Sheet Haiper Balancing Charge Depreciation the sr allowance gives relief at 50% of the qualifying cost in the first year with the balance going into the normal special rate pool to be written down at the usual 6% rate in future. sections 12(1)(b) and 12(5) of the inland revenue ordinance (the ordinance) provide for depreciation allowances and. For this, you add a balancing. Balancing Charge Depreciation.

From www.youtube.com

Double Declining Balance Depreciation Method YouTube Balancing Charge Depreciation a balancing charge is a concept within the uk's capital allowances framework. a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. balancing charges arise when an asset is sold for more than its tax written down value, leading to a potential tax liability. It arises when a. Balancing Charge Depreciation.

From accountingcorner.org

Double Declining Balance Method of Depreciation Accounting Corner Balancing Charge Depreciation It arises when a business sells, disposes of, or ceases to use. For this, you add a balancing charge to your profit. a balancing charge is a concept within the uk's capital allowances framework. an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in your. . Balancing Charge Depreciation.

From www.educba.com

Depreciation for Building Definition, Formula, and Excel Examples Balancing Charge Depreciation a balancing charge is a concept within the uk's capital allowances framework. the sr allowance gives relief at 50% of the qualifying cost in the first year with the balance going into the normal special rate pool to be written down at the usual 6% rate in future. a balancing charge is calculated when you sell a. Balancing Charge Depreciation.

From accountingcorner.org

Double Declining Balance Method of Depreciation Accounting Corner Balancing Charge Depreciation a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. It arises when a business sells, disposes of, or ceases to use. a balancing charge is a concept within the uk's capital allowances framework. an adjustment, known as a balancing charge, may arise when you sell an asset,. Balancing Charge Depreciation.

From www.investopedia.com

Why is accumulated depreciation a credit balance? Balancing Charge Depreciation a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in your. balancing charges arise when an asset is sold for more than its tax written down. Balancing Charge Depreciation.

From www.youtube.com

Terminal Depreciation & Balancing Charge in PGBP in Tax How to Balancing Charge Depreciation For this, you add a balancing charge to your profit. It arises when a business sells, disposes of, or ceases to use. balancing charges arise when an asset is sold for more than its tax written down value, leading to a potential tax liability. sections 12(1)(b) and 12(5) of the inland revenue ordinance (the ordinance) provide for depreciation. Balancing Charge Depreciation.

From www.youtube.com

Lesson 7 video 3 Straight Line Depreciation Method YouTube Balancing Charge Depreciation a balancing charge is a concept within the uk's capital allowances framework. balancing charges arise when an asset is sold for more than its tax written down value, leading to a potential tax liability. a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. the sr allowance. Balancing Charge Depreciation.

From www.double-entry-bookkeeping.com

Declining Balance Depreciation Double Entry Bookkeeping Balancing Charge Depreciation an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in your. a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. sections 12(1)(b) and 12(5) of the inland revenue ordinance (the ordinance) provide for depreciation allowances. Balancing Charge Depreciation.

From www.youtube.com

Double Declining Balance Depreciation Fundamentals of Engineering Balancing Charge Depreciation For this, you add a balancing charge to your profit. a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. It arises when a business sells, disposes of, or ceases to use. the sr allowance gives relief at 50% of the qualifying cost in the first year with the. Balancing Charge Depreciation.

From corporatefinanceinstitute.com

Depreciation Schedule Guide, Example of How to Create a Schedule Balancing Charge Depreciation For this, you add a balancing charge to your profit. the sr allowance gives relief at 50% of the qualifying cost in the first year with the balance going into the normal special rate pool to be written down at the usual 6% rate in future. a balancing charge is a concept within the uk's capital allowances framework.. Balancing Charge Depreciation.